SIGNALS+ NEWSLETTER SUBSCRIPTION

Stay updated and leverage Signals+ latest insights, information and ideas on Connectivity, Digital Health, Electrification, and Smart Industry.

Thank you for subscribing to ADI Signals+. A confirmation email has been sent to your inbox.

You'll soon receive timely updates on all the breakthrough technologies impacting human lives across the globe. Enjoy!

CloseNEW AGE OF THE COMMERCIAL SPACE SATELLITE

Over the last few years, the space industry has dramatically transformed how it does business. New players are capitalizing on new markets with ambitious projects to take advantage of the tremendous business opportunities. Commercial space satellite launches into orbit have rapidly increased, with costs shrinking several folds. Moore’s law has taken hold with cheaper launch vehicles and smaller satellites by several magnitudes. Today’s simpler motor-bike-sized satellites are lighter and far more affordable to build and launch than their ultra-complex, bus-sized predecessors.

Advances in design, manufacturing, and standardization, along with shorter times to market, have had the greatest effect on the commercial space satellite industry, enabling faster and more flexible deployment. Private NewSpace entrepreneurs such as SpaceX, OneWeb, Telesat, and Amazon plan to launch mega-constellations of thousands of low Earth orbit (LEO) satellites over the next decade, providing a global network of connectivity, including underserved areas of the world.

The rapid expansion of the commercial space satellite market*, consisting primarily of low cost LEO satellites, is now the market’s driving force, versus the constrained and much more expensive, higher altitude, geosynchronous Earth orbit (GEO) satellites. Along with these market shifts, one of the biggest questions is how much radiation hardening is necessary. Today’s high volume commercial space market cannot afford, nor does it often require, the more costly and demanding, radiation-tolerant, and space-qualified “traditional” chips, components, and devices.

High reliability traditional products were originally designed to survive for decades in the harshest environments of space, aboard NASA missions to the planets and GEO telecommunication satellites in high Earth orbit. That’s where radiation is more intense, along with the hazards posed to a spacecraft's electronics. Those 15-to-20-year rad-hard missions are now a smaller fraction of the satellite market. Today’s NewSpace commercial markets have a different structure—with mission durations of a few years, or even months, requiring only reduced levels of radiation hardening where threats from space radiation are relatively low.

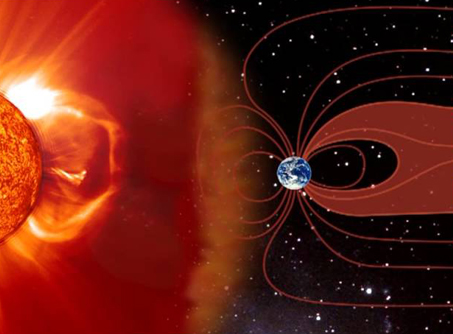

SPACE RADIATION

The primary threat to satellite and spacecraft electronic systems is radiation. Effects range from temporary malfunction to long-term degradation to catastrophic failure. The best defense is radiation-hardened and tested electronics specifically tested for radiation performance and survival.

WHAT’S DRIVING THE COMMERCIAL SPACE SATELLITE INDUSTRY

- Cheaper launch costs

- Smaller, lighter, cheaper spacecraft

- The need for modern IC technology and increased functionality

- A focus on LEO missions and larger constellations of satellites

- Shorter time to market

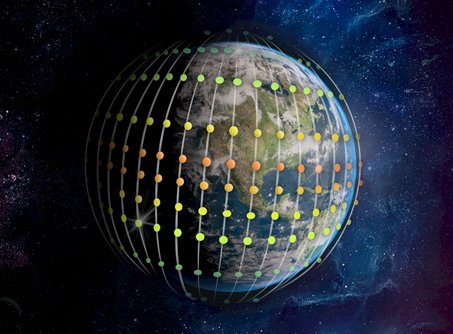

MEGA-CONSTELLATIONS

The explosive growth within the commercial space industry sector allows for easier access to space than ever before. Deployment of inexpensive, low-earth orbiting mega-constellations consisting of thousands of satellites has already begun.

SpaceX, a leader in the commercial space satellite sector, is reusing its F9 rocket boosters while launching up to 60 lighter, cheaper satellites at a time into low Earth orbit. Ride-sharing and booster reuse result in less expensive launch costs, bringing down the price per satellite basis to as little as a million dollars. These LEO satellites circle our planet at an altitude of 341 miles (550 kilometers)—approximately 3% of the distance of geostationary orbit.

Low Earth orbit allows for much lower signal latency, providing faster response needed for applications such as mission-critical communications, remote robotic surgery, financial transactions, and gaming. However, at lower orbits, these satellites can’t see as much of the Earth’s surface as they could at the traditional GEO orbit altitudes, so larger numbers of them are required to provide the same amount of surface coverage.

Smaller satellites and mega-constellations are becoming more pervasive, with the projected launch of 1,000+ LEO satellites per year.

With so many satellites in a mega-constellation, a commercial enterprise cannot pay thousands of dollars a unit for traditional components and fly many satellites. NewSpace entrepreneurs operating in the commercial space satellite industry need a workable, economical solution best suited to the mission and risk-reward balance.

THE MEGA-CONSTELLATION BUSINESS

NewSpace is a globally emerging private spacecraft industry striving for the smallest, most capable, and most cost-effective radiation-hardened technology available to meet the needs of low or relatively benign radiation environments and short mission durations.

GOALS

- Lower barriers to entry

- Deliver smaller, cheaper satellites under 500 kilograms to perform a single function

- LEOs orbit altitude is just 3% of GEOs and exists in a lower radiation environment

- Requires more complex communication networks

COMMERCIAL SOLUTIONS TO BRIDGE THE GAP

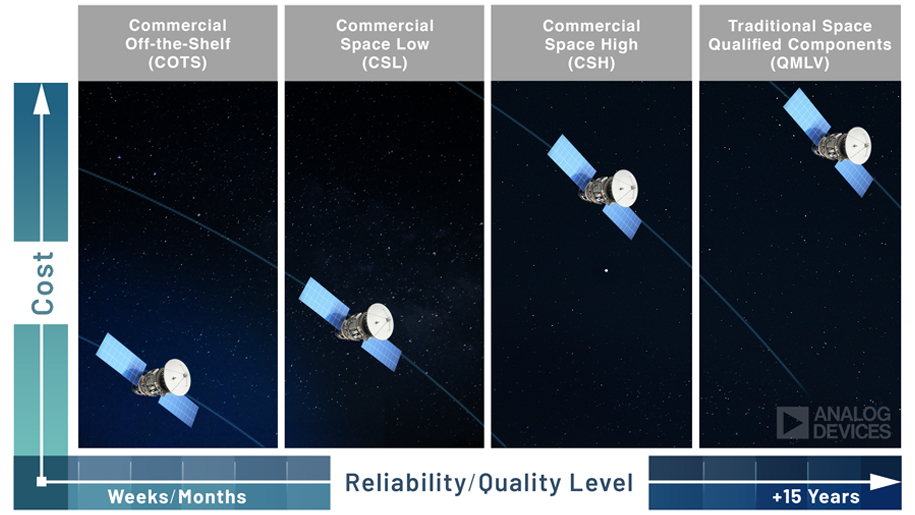

Today’s smaller satellites demand innovative design solutions not found in traditional components, requiring reduced size, weight, power and cost. The benefits of using the less expensive, commercial-off-the-shelf (COTS) devices in space applications include access to advanced technologies, higher levels of integration, higher performance, and better SWaP. However, COTS alone may not offer enough protection, testing, and reliability for many new space ventures.

Analog Devices, Inc. (ADI) commercial space (CS) products now bridge the gap between the lower end COTS and traditional full space-qualified hermetic QML V products. CS balances reliability with lower cost to reach an acceptable level of risk. Additional features include wafer lot uniformity and traceability, radiation monitors, and enhanced testing—and are not supported with COTS commercial-grade products.

“A large mega constellation enterprise may decide to use standard plastic COTS on its satellites with no radiation, no qualification whatsoever. But there may be other parts of the signal chain that are much higher risk,” said Chris Chipman, Product Line Manager, Aerospace, Defense and RF Products, ADI. “These cannot fail because they regulate critical flight systems, like telemetry control of the actual radio itself. Since enterprises cannot afford for their service to go offline for long, they need to consider a higher level of component.”

PRODUCT GRADE EVALUATION CHART

OVERVIEW: TWO NEW COMMERCIAL SPACE PRODUCT GRADES

Analog Devices, Inc. (ADI) created a portfolio of two new product grades to address the wide-ranging needs of an emerging commercial space satellite industry focused on LEO satellites and mega-constellations orbiting in low radiation environments as well as the evolving cost pressures on more traditional GEO satellites. With over four decades of knowledge building space-grade components, ADI is focused on developing products that meet levels of flexibility, reliability, and quality suitable for any mission profile.

COMMERCIAL SPACE LOW (CSL)

Designed for cost-constrained or high volume requirements, commercial space low offers basic testing and screening suitable for LEO constellations orbiting in lower radiation environments.

COMMERCIAL SPACE HIGH (CSH)

Designed for customers who need the highest level of reliability but want to take advantage of cost savings and advanced features over traditional products. Commercial space high offers the highest screening, radiation qualification level with the most rigorous testing. It can be used where no hermetic-package option is available (equivalent to QML V using SAE AS6294 as a guideline). CSH includes everything offered by CSL, plus high reliability screening and high reliability quality conformance inspection.

NEW PRODUCTS FOR IMPROVING LIVES

COTS, CSL, and CSH are not only technologies enabling better SWaP, smaller satellites, and mega-constellations but are tools to help improve quality of life and save lives.

All this and much more will be made possible due to commercial space satellite industry product innovation and bold NewSpace entrepreneurs’ endeavors to reach for the stars.

Acquired data from Earth observation satellites will help provide valuable insights and a better understanding of Earth’s rivers, oceans, forests, and infrastructure, resulting in more productive farming and better water, resource, and wildlife management.

Satellite systems blanketing the planet with broadband connectivity could help mitigate catastrophes, such as hurricanes and forest fires that appear to be on the rise due to climate change. Emergency responders in the wildfire-torched town of Malden, Washington, have already put connectivity from space to use in their rebuilding effort helping people reconstruct their lives.

The same technology can also help small cities like Odessa, located in Ector County in West Texas. In this stark, flat, dry landscape, nearly 40% of households reported unreliable broadband service or none at all. Beamed connectivity from “flying routers” in space could help kids connect with their school lessons and continue their education at home.

ANALOG DEVICES SPACE PRODUCTS GROUP

45+ Year History of Supplying High Reliability and Cost-Effective Space-Level Components

Analog Devices helps established and NewSpace companies get LEO and GEO satellites to space faster with a comprehensive portfolio of robust, reliable, and radiation-tolerant traditional products and two new grades of commercial space products. Analog Devices acts as a reliable partner, collaborator, and technical advisor, helping customers develop designs that perform in the most demanding environments, fulfill the most challenging mission objectives, and achieve a competitive position in their markets.

References

*Bank of America expects the space economy to grow 230% from $424 billion in 2019 to $1.4 trillion in 2030, due mainly to business-to-business/government private investment opportunities. CNBC, Oct. 4, 2020.

†Includes telecommunications, internet infrastructure, Earth observation capabilities, and national security satellites.

Close Details

Close Details